If you ask an average bettor how they are doing, they’ll tell you their record over the last week. "I went 4-1 on Sunday," they'll say, chest puffed out.

If you ask a professional bettor how they are doing, they won't mention wins and losses. They will talk about their Closing Line Value (CLV).

In the world of sharp betting, results are noisy. You can make a terrible bet and win because a cornerback tripped. You can make a mathematically perfect bet and lose because of a fluke fumble on the one-yard line. Over a small sample size, luck dominates sports betting.

But over the long haul, math dominates. And the ultimate mathematical measurement of whether you are a skilled bettor or just flipping coins is CLV. That is why it is #1 on this list. If you don't understand this concept, you cannot win long-term.

The Efficient Market Hypothesis applied to Sports

To understand CLV, you have to respect the market. The sports betting market is incredibly efficient, especially right before kickoff.

Throughout the week, syndicates bet big money, injury news breaks, and weather forecasts solidify. The books adjust the lines based on this influx of information and liability. By the time the game starts (closing time), the line represents the consensus of the smartest, richest players in the world. It is the single most accurate prediction of the game's outcome probability.

The "Closing Line" is the true price of the asset.

Defining CLV

Closing Line Value equals the difference between the odds you bet and the odds at kickoff.

It’s simple: Did you get a better price than the market settled on?

-

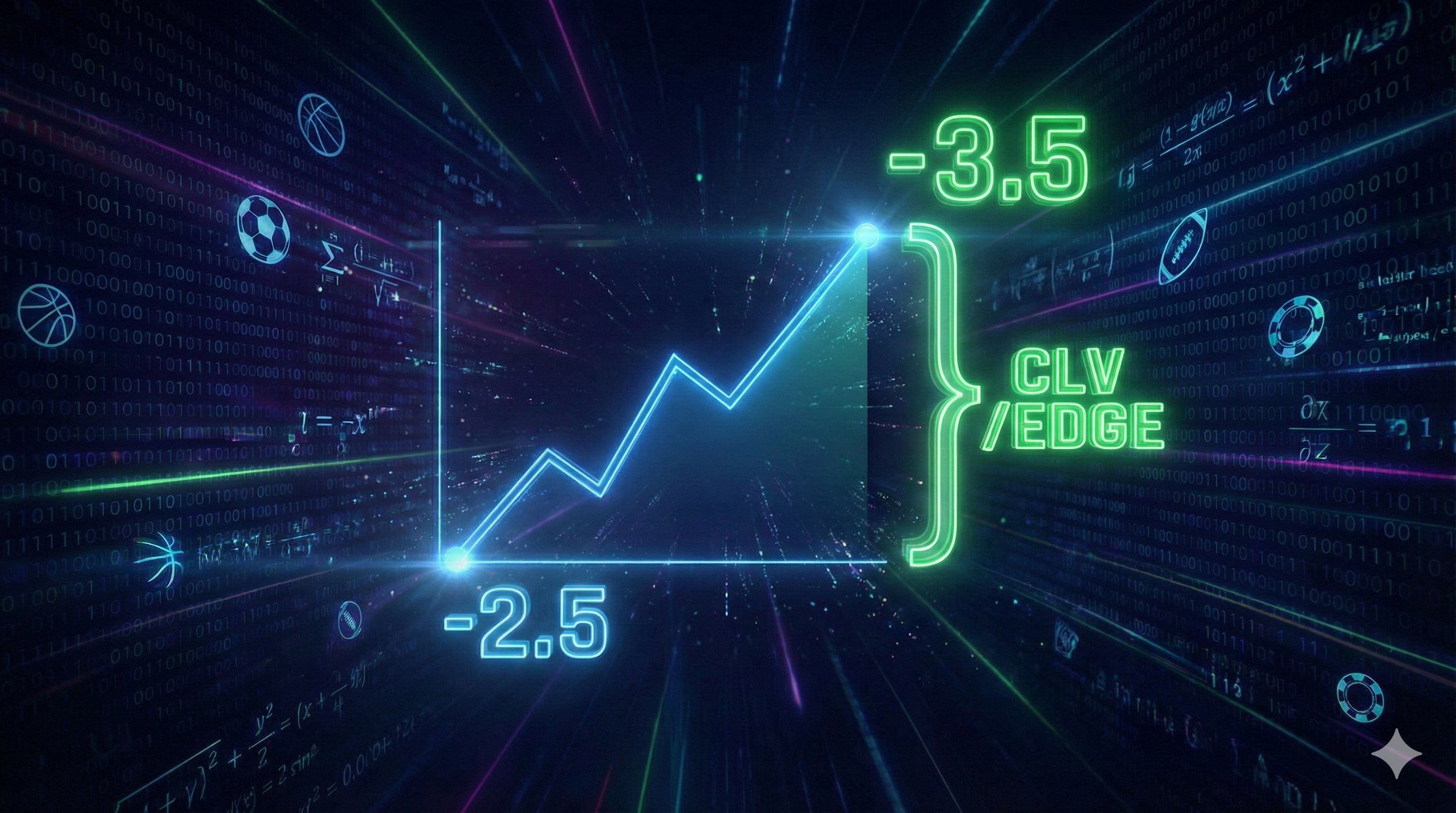

Positive CLV Example: On Tuesday, my model flagged the Chiefs as undervalued. I bet them at -2.5 (-110). By Sunday kickoff, heavy sharp action pushed the line up, and the market closed at Chiefs -3.5 (-110).

-

I beat the market by a full point and key number. I bought an asset for $2.50 that the rest of the world agreed was worth $3.50 by the end of the week. I have positive CLV. Whether the Chiefs cover or not, that was a "winning" bet in terms of process.

-

-

Negative CLV Example: You bet the Cowboys on Sunday morning at -6.5 because you like their offense. Sharp money comes in on the other side, and the game closes at Cowboys -5.5.

-

You took a worse price than the market consensus. You overpaid for the asset. You have negative CLV. Even if the Cowboys win by 20, you made a "losing" bet mathematically.

-

Why It Matters More Than Winning

If you consistently beat the closing line, you are, by definition, betting at probabilities that are more favorable than the actual true odds of the event. You have a mathematical edge.

If you are consistently beating the closer, you will be profitable over a large sample size (think 1,000+ bets). The math makes it inevitable.

Conversely, if you rarely have CLV, you are consistently overpaying. The sportsbook's vigorish (the 'vig' or 'juice') will grind your bankroll to zero. You might have a hot month, but regression will hit you like a freight train.

The Takeaway

Stop obsessing over whether your bet won or lost yesterday. Start obsessing over your process.

Did you move the line? Did you get the best of the number? If you bet something at +140 and it closes at +120, pat yourself on the back. You did your job as a handicapper.

If you are serious about this, start tracking the closing lines on every single bet you make. If you aren't beating the closer regularly, your strategy is flawed, and the data proves it.