I have seen guys who can hit 58% of their NFL prop bets—a Hall of Fame level win rate—wash out of the industry in two months.

Why? Because they bet too much when they were hot, and they chased losses when they were cold. They had the edge, but they lacked the math to manage it.

In sports betting, finding the winner is only half the battle. The other half is knowing exactly how much to wager on it.

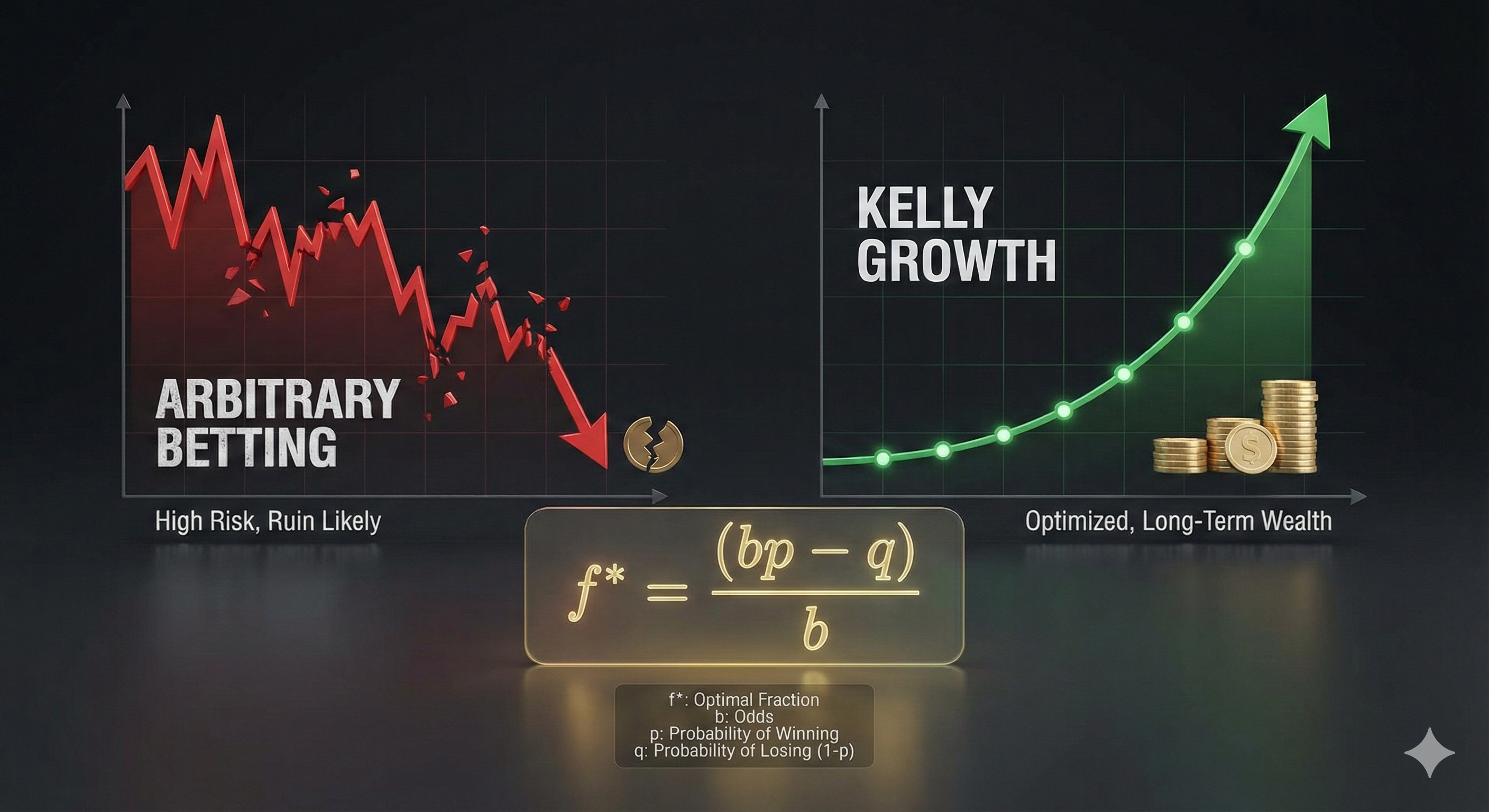

Enter John Kelly, Jr. In 1956, while working at Bell Labs, he developed a formula to determine the optimal size of a series of bets to maximize the logarithm of wealth. In plain English: It calculates the exact amount you should bet to grow your bankroll as fast as possible without going broke.

This isn't opinion. It is the physics of gambling.

The Formula

The core formula for the Kelly Criterion is:

Where:

-

$f^*$ = The fraction of your current bankroll to wager.

-

$b$ = The decimal odds minus 1 (e.g., -110 odds is 0.91).

-

$p$ = The probability of winning (your calculated edge).

-

$q$ = The probability of losing ($1 - p$).

A Simple Example:

Let’s say you are betting a coin flip (50% probability), but you are getting +110 odds ($b = 1.1$). You have a massive edge.

-

$p = 0.50$

-

$q = 0.50$

-

$b = 1.1$

The math says you should bet 4.5% of your bankroll on this wager.

The Danger: Why You Should Use "Fractional Kelly"

Here is where the data analysts separate themselves from the reckless gamblers. The formula above assumes you know the exact probability of winning. In sports, we don't. We have models, we have estimates, but we never have certainty.

If your model says the Chiefs have a 60% chance to win, but they actually only have a 55% chance, betting "Full Kelly" will cause you to over-bet. Over-betting leads to the Risk of Ruin (going to zero).

Because of this uncertainty, smart bettors use Fractional Kelly—usually Quarter Kelly (1/4) or Eighth Kelly (1/8).

-

If the formula says bet 4%, a Quarter Kelly bettor wagers 1%.

This smooths out the variance. You won't get rich overnight, but you also won't blow your account on a bad three-week run.

The Tyler Morgan Rule

If you take nothing else from this, remember my standard sizing rules for the serious bettor:

-

Standard Play: 1% of Bankroll (Quarter Kelly usually lands here).

-

Premium Play (High Edge): 2% of Bankroll.

-

Maximum Play (Massive Edge/Mistake Line): 3-4% of Bankroll.

Never, under any circumstances, put 10% of your net worth on a single game. That isn't investing; that's burning money.

The Takeaway

Your bankroll is your inventory. If you run out of inventory, you are out of business.

The Kelly Criterion forces you to bet more when your edge is high and less when your edge is low. It takes emotion out of the equation. Stop guessing your bet sizes based on how "confident" you feel. Run the numbers, cut the result in half (or a quarter) for safety, and let the compound interest work its magic.