Sportsbooks don't want you to think in percentages. They want you to think in "favorites" and "underdogs." They use American odds (like -110 or +240) to obscure the true cost of a bet.

As a sharp bettor, your first job is to translate their language into yours. That language is Implied Probability.

What is It?

Implied probability is the conversion of betting odds into a percentage. It tells you exactly how often a bet needs to win for you to break even.

-

The Formula for Negative Odds (Favorites):

$$Probability = \frac{Odds}{Odds + 100}$$-

Example (-150): $150 / (150 + 100) = 0.60$ or 60%

-

-

The Formula for Positive Odds (Underdogs):

$$Probability = \frac{100}{Odds + 100}$$-

Example (+200): $100 / (200 + 100) = 0.333$ or 33.3%

-

Why It Matters

Every time you place a bet, you are making a claim. If you bet on a team at +200, you are claiming: "This team will win this game more than 33.3% of the time."

If your model says the team actually has a 40% chance to win, you have an edge.

If your gut says they have a 30% chance, you are lighting money on fire—even if the payout looks nice.

The Breakeven Point

The most important number in sports betting is 52.38%.

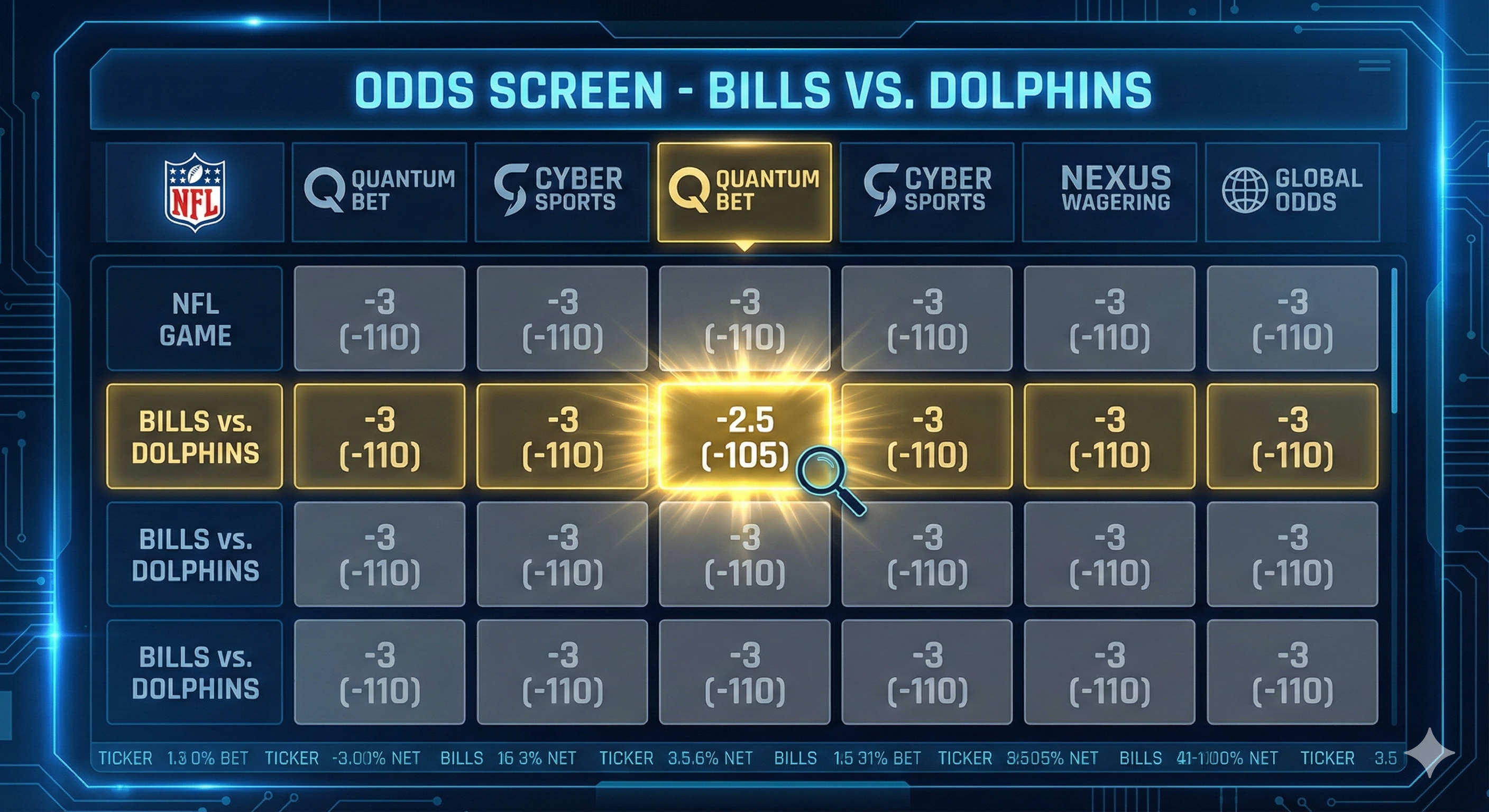

This is the implied probability of -110 (standard juice). To be a profitable bettor on standard spreads, you must win more than 52.38% of your bets. If you hit 52.0%, you are losing money to the vig.

Stop looking at the payout. Start looking at the probability. If the math doesn't clear the hurdle, pass the bet.